Doing Right by Your Donors: Auditing Gift Management

February 1, 2017

As the pressures mount for college affordability, capital campaigns and fundraising activities have become more ambitious. Higher education institutions are investing more resources in development efforts and are relying more on the generosity of their donors. With the vast array and complexities of donor requirements, the multifaceted nature of gift management efforts, and the evolving compliance landscape, the gift acceptance process can be complicated and can put the institution at risk for accepting a gift agreement they cannot adhere to or honor.

Common Risks an Institution May Face

Some common examples of risks related to accepting, processing, managing, and reporting of a gift include:

- Accepting a gift that does not align with the institution’s mission and strategy;

- Distributing restricted funds to a department or division that uses them for an unintended purpose;

- Experiencing environmental or institutional changes whereby the original intended purpose for a restricted gift is no longer applicable;

- Misreporting fund use to donors; and

- Spending and releasing funds in a way that is not consis

tent with relevant regulations.

tent with relevant regulations.

These risks can dissuade potential donors from making contributions, can require substantial resources to manage, or even lead to costly litigation and damages that can negatively impact future giving from existing donors.

Taking Action

Proactive institutions have initiated reviews of their operations for all parts of the gift management lifecycle from gift cultivation to donor reporting in order to identify possible gaps and compliance considerations. These efforts usually involve collaboration among a number of functions, including development, finance, legal, and operations. Each of these functions, and others depending on the nature of the gift, plays an important role in the gift management lifecycle.

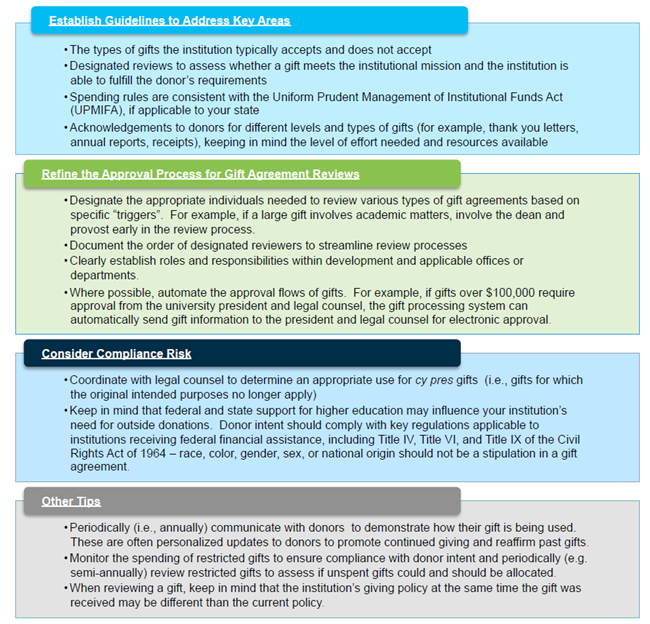

Practical Tools and Approaches for Managing Restricted Donor Gifts

Colleges and universities can take a number of steps to help position themselves to meet donor intent. We have identified areas for Internal Auditors to consider as they endeavor to support their institutions. This work will bring greater visibility to risks and insight into processes and controls that institutions should consider when receiving and managing gifts from donors.

Proactive institutions have initiated reviews of their operations for all parts of the gift management lifecycle.

Donors can be students, alumni, faculty, and friends of the university; doing right by them will help your institution continue to thrive in an increasing complex and costly operating environment. By taking a proactive approach to helping your institution deliver high quality service and interactions with its donors, you will create a virtuous cycle that will pay considerable dividends to your internal audit shop and the broader institution into the future.

About the Authors

Chris Garrity

Chris Garrity, CPA, CIA, CFE is the Chief Audit Executive at Saint Joseph’s University of Philadelphia, Pennsylvania. Chris has over 20 combined years of experience within the not for profit and healthcare industries. His experience includes...

Read Full Author Bio

Chris Garrity

Chris Garrity, CPA, CIA, CFE is the Chief Audit Executive at Saint Joseph’s University of Philadelphia, Pennsylvania. Chris has over 20 combined years of experience within the not for profit and healthcare industries. His experience includes performing and supervising numerous fraud investigations as well as financial, operational, and compliance audits. Chris has also provided advisory and consulting services to audit committees, boards, counsel, and management in business and issues such as endowments, enterprise risk management, process reengineering, and ERP implementations.

Articles

Climbing the Ranks: Preventing Fraud and Misreporting in Institutional Data

Doing Right by Your Donors: Auditing Gift Management

John Kiss

John Kiss is a director in Baker Tilly Virchow Krause’s higher education, risk, internal audit and cybersecurity practice, and has more than 14 years of experience in risk management and internal audit. He has a diverse industry background...

Read Full Author Bio

John Kiss

John Kiss is a director in Baker Tilly Virchow Krause’s higher education, risk, internal audit and cybersecurity practice, and has more than 14 years of experience in risk management and internal audit. He has a diverse industry background across higher education, healthcare, commercial and government entities. His experience includes providing forensic accounting services, auditing business processes and controls, conducting enterprise-wide risk assessments, and performing strategic reviews.

Articles

Doing Right by Your Donors: Auditing Gift Management

Leveraging ERM to Increase Internal Audit Relevancy