Emerging Technologies’ Impact on Construction Audits

February 19, 2021

Introduction

The construction industry has historically been a slow adopter of technology, and rightfully so. The builders of our roads, homes, offices, and campuses need to be thoughtful when evaluating new technology that may impact safety and quality in exchange for speed and cost reduction. Consequently, the introduction of robotics, video monitoring, and automated quality controls has trailed behind other industries, such as manufacturing and distribution. Similarly, as the availability of digital information has increased, the implementation of automated construction audit techniques has lagged. However, high speed wireless communication, handheld devices, and a need for labor force alternatives continues to drive construction technology innovation and adoption. Construction auditors must remain knowledgeable with the latest industry tools and understand how to evaluate new construction technologies’ impact on construction risk management.

Technology and Construction Project Data Automation

The most established technological advancements, such as GPS-enabled cranes and heavy/highway equipment with onboard performance metrics, enable operators to cut, grade, and measure moved earth with a high degree of precision. The equipment can be monitored remotely, which allows companies to track their exact location, operating hours, consumables, and environmental conditions. The existence of this data also provides information for construction audits. Rather than analyzing paper copies of supporting documentation, construction auditors may now utilize available digital technology to download equipment metrics and capture quantities moved, hours operated, and other pertinent equipment usage data quickly.

Rather than analyzing paper copies of supporting documentation, construction auditors may now utilize available digital technology to download equipment metrics.

A large campus transformation project may include new buildings, new roads, and new underground infrastructure. This would require moving large amounts of dirt and parking contractor equipment at the jobsite, resulting in monthly bills for dirt hauling, aggregate purchases, and heavy equipment rental. To determine whether the quantities billed are representative of actual activity, an engineer could measure the dimensions of the dirt (i.e., how high and wide the dirt sits) to calculate the quantities moved.

Alternatively, the auditor could download the operating metrics from any cloud storage application to see the number of dump trucks that were on site, the trips each truck made, the weight of the product hauled, and the time spent loading and unloading. The auditor could then calculate cubic yards moved from the site to reconcile the trucking bill. A similar reconciliation could be performed using operating hours, GPS coordinates, and performance metrics from earthmoving equipment.

In addition, there are other methods of construction automation. One example is modular construction, which is an effective alternative to on-site construction methods. Modular construction is a process, in which a building constructed off-site under controlled plant conditions, uses the same raw materials as conventionally built facilities, and adheres to the same industry codes and standards—in about half the time. Buildings are produced in “modules,” which when put together on-site, reflect the identical design intent and specifications of the most sophisticated site-built facility. Furthermore, controlled plant conditions enable the contractor to leverage trade and craft automation to build walls, assemble plumbing, and fabricate ductwork.

Modular construction automation leads to the following areas of note:

- Treatment of Sales Tax: Many higher education institutions benefit from sales tax exemptions. Auditors must be assured that the modular or unit pricing excludes any sales tax that may be embedded within the unit price. Additionally, purchase orders for raw materials can be reviewed to identify any disallowed sales tax incurred during procurement.

- Potentially Duplicate Costs: Costs such as insurance, transportation, and warehousing could be duplicated in the unit pricing as well as the pay application. Modular builders frequently utilize enterprise resource systems, such as Oracle or SAP, that have fully loaded bills of material. The bill of material will contain a breakdown of the unit price, as well as the associated labor costs, and an equipment rate for any applicable robotics. It is important to review the details disclosed in the pay application to know where costs are being billed (and billed only once).

Digital Data Collection and Associated Risks

Data collection is an area that has experienced great advancement the last few years. Two areas that benefit from construction audits include employee tracking and direct labor hour collection. Historically, timesheet collection was a manual process and often the burden of the superintendent on the construction project. Now, mobile phone applications allow individual employees to enter their time and automatically forward their timesheet to the superintendent for approval. Once approved, the labor cost will post to the job cost ledger. In addition, large multi-disciplined projects are implementing wireless jobsite worker tracking. The employee enters through a control gate and swipes an identification card or wears a radio-frequency identification (RFID) badge, which captures physical jobsite location and enables the contractor to know, at any given time, who is on the jobsite and their location. The construction auditor may use this data to verify personnel and the number of hours worked on the jobsite. By reconciling this jobsite data with timesheet data and physical locations, timesheet errors can be detected and worker productivity can be audited.

As automated and digital data collection becomes more prominent, it will be necessary to place greater reliance on project controls to detect fraudulent or abusive behaviors.

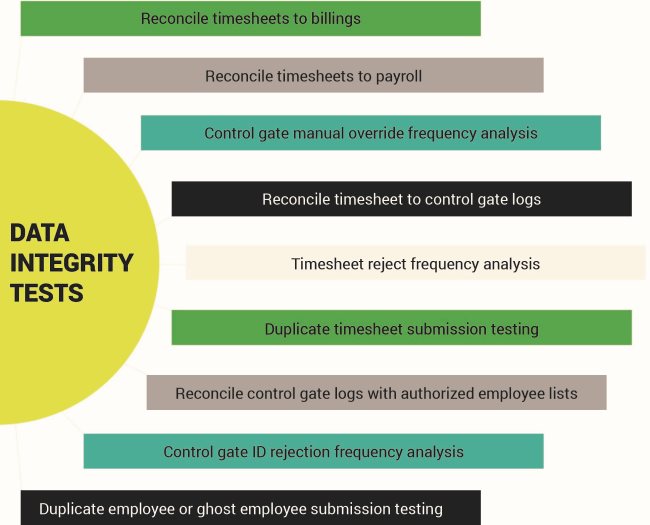

As automated and digital data collection becomes more prominent, it will be necessary to place greater reliance on project controls to detect fraudulent or abusive behaviors. Auditors should thoroughly test the project controls before relying on these systems to generate accurate source transactions. Comprehensive audit programs should include project controls testing that include employee identification card issuance and replacement, timesheet rejection processes, rejection frequency tracking, and payroll-to-job cost adjustment reconciliations. In addition, audit programs should also include data integrity testing to gain assurance that the data collection and reporting systems are functioning as intended. The graphic shown below highlights some common data integrity tests.

Previously, construction audits often experienced roadblocks due to the inaccessibility of information. Today’s automation systems are digitizing source documents; therefore, enabling a more comprehensive testing at a lower cost per transaction tested. While this may provide an opportunity for more automated audit procedures, the audit methodology does not change.

Audit Methodology

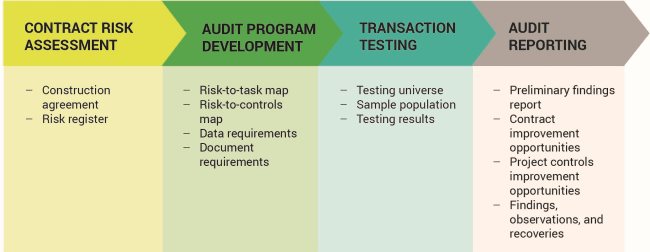

Each phase of the methodology benefits from technological advancements and automation.

Phase 1: Contract Risk Assessment

This phase includes a technical review of the contract terms and conditions. By applying any past risk assessment experience, the contract terms are equated with known risks. For example, the cost of work requires labor burdens to be billed and reimbursed at cost, without additional markup. Some associated risks with labor billed in excess of cost may include inflated labor burden, duplicate benefit hours, or embedded profit. Business intelligence software now allows auditors to compile a database of past contract observations, and when paired with optical recognition software, a contract can be scanned and then the contract terms are mapped to known risks. The results produce a system generated preliminary contract risk analysis, which significantly reduces the amount of time to perform this same task manually.

Phase 2: Audit Program Development

Contract risks are mapped to a series of audit steps, allowing business intelligence software to then produce a draft audit program based on the associated contract risks. The database maintains the data requirements for the audit program and associated supporting documentation requirements, which is then provided to the contractor and owner so the audit can proceed.

Phase 3: Transaction Testing

Many transaction tests and reconciliations can be automated, which eliminates redundant data handling and relevant constraints on construction audit progress. Regardless of whether an auditor has a fully integrated business intelligence solution that can perform the testing, experience is still required to interpret the data, evaluate results, and assess whether new scenarios exist that were not addressed within the automated testing environment.

With the increases in the level of automation, auditors’ responsibilities grow significantly.

Phase 4: Audit Reporting

With the increases in the level of automation, auditors’ responsibilities grow significantly—whether it is an increase in testing or placing a greater emphasis on project controls interviews, control effectiveness, and results interpretation to mitigate construction project risk. Automation allows an increase in sample size and overall testing populations, which allows auditors to get better coverage and have more detailed findings.

Conclusion

Despite all the advances in technology that impact the construction industry, the audit solution is only as good as the subject matter experts that assess the contract risks and develop audit programs. Auditors will be needed regardless of the level of automation and should not be concerned about automation eliminating their jobs.

About the Author

Tony Ollmann

Tony Ollmann is apartner with Baker Tilly’s construction risk management practiceand has more than 20 years of experience in the construction industry providing consulting services.

Read Full Author Bio