Tips for New Internal Auditors

Starting a new job can be both exhilarating and daunting at first, and starting a new job as an internal auditor is no different. Internal audit is a unique and continuously evolving profession where internal auditors play a critical role in an organization’s operations and corporate governance. Internal auditors use their experience and knowledge of laws, regulations, and organizational policies to examine and analyze an organization’s financials and identify potential occurrences of noncompliance, fund misappropriation, and other risks to the organization. Becoming an internal auditor is rewarding and has a great opportunity for professional development and advancement. Here is what new internal auditors should do to be successful in their career.

Seek a mentor

All internal auditors, whether this is your first year as an internal auditor or you have over 25 years of auditing experience, can benefit from having a mentor. Mentors help internal auditors understand their profession and career opportunities. It is important to find a suitable mentor who has more industry experience, shares similar values or goals, and is someone you admire. The right mentor should be your biggest ally and have a passion for teaching while allowing you to be your own advocate.

Learn and understand the basics of internal auditing and how to conduct an audit

To begin in this field, you must learn the standards that govern the process. The IIA Standards on performance explain the processes for planning, performing, reporting, and following up on audit engagements. The sooner you become familiar with these concepts, the faster you will be able to understand and apply this knowledge for developing and performing internal audits.

Relax and stay calm

When starting a new job, internal auditors tend to put an immense amount of pressure on themselves to be perfect. Internal audit is known for having a steep learning curve, so new auditors should take a deep breath, relax, and know that you are not alone. There will be other auditors, managers, and directors to help you learn your department’s procedures and answer any questions you may have.

Know your limits and when to ask for help

One of the hardest things for new internal auditors to learn is when to speak up and ask for help. Auditing is very technical, and it is highly unlikely that a new internal auditor will be a compliance, accounting, or fraud expert overnight. Do not spend hours trying to figure things out on your own. Rather, seek guidance from a more experienced colleague who can help you. Knowing your limits and knowing when to ask for help can save you time and reduce frustration and misunderstandings.

Be eager to learn and develop new skills

As an internal auditor, you analyze a variety of processes and interact with all levels of employees and subject matter experts. Do not be afraid to ask questions that will help you understand what you are auditing. As time goes on and you gain more experience, you will learn that internal audit is about striking a balance between understanding the big picture and focusing on the small details. Having a good knowledge of your organization’s policies, procedures, and risks will make you a standout internal auditor.

Sharpen your communication skills

Although communication skills are essential in any job, internal audit requires developing two key skill sets: effective writing and effective interviewing. An internal auditor’s writing should be objective and clear, making compelling arguments that present your audit results effectively. For successful interviews, internal auditors must be prepared, ask the right questions, listen, take good notes, and confirm their understanding of the processes and controls being audited. It is also extremely important that the interview is not one-sided but flows naturally from both sides.

Be a sponge by listening and absorbing all the information

As an internal auditor, you will have the opportunity to interact with, and learn from, all levels of employees, including interns, associates, managers, VPs, and directors. You can learn something from everyone you encounter, so be open-minded and receptive. Take note of the valuable skills others possess, such as communication, organization, leadership, and networking skills and learn from them.

Volunteer and get involved in areas outside of your comfort zone

New internal auditors are usually assigned to a variety of different audit engagements before they begin to specialize in certain areas or become subject matter experts. Learn as much as possible from your different engagements, and volunteer to be put on engagements that are not so glamorous, ones you know nothing about, or topics you want to learn more about. By exploring different assignments, you may find a preference for a particular area and may have the opportunity to work with a subject matter expert. If you volunteer to get involved in areas you are unfamiliar with, management and others will take notice of the effort. Your passion may be hidden somewhere you would have not explored if you did not push yourself.

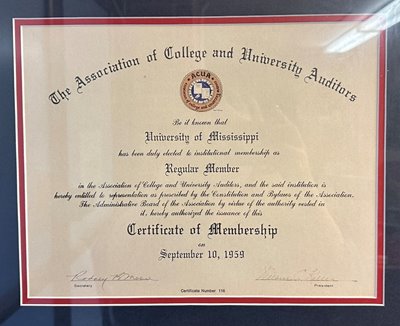

Join a professional network or organization

Consider joining networks or organizations that support and cater to your interests, professional growth, and development. These groups usually offer members training opportunities to help you enhance your skills and stay current on auditing news and publications. Becoming a member of network groups or organizations can also help you grow your professional network and learn about other career opportunities.

Enjoy the experience

You are only a new internal auditor for a brief time. The beginning of your internal audit experience should be embraced because there is no other time in your auditing career when so much knowledge is obtained in such a short period. In addition to the new experiences and learning curve, new auditors are exposed to a vast array of unique individuals with wonderful backgrounds and experiences. Embrace the relationships you develop and the things you learn along the way. But most importantly, enjoy the journey!