Athletics Business Office: Emerging Changes and Challenges

By Rachel Flenner, Bret Malone, and Marie Jackson

With recent developments such as Name, Image, and Likeness (NIL) regulations and emerging revenue‑sharing models as a result of the House vs NCAA settlement, many institutions may not fully recognize how significantly these changes impact the Athletics Business Office (ABO). The ABO is now responsible for executing payments to student-athletes arising from revenue-sharing agreements. Also, the ABO must update their NCAA reporting related to new line items related to the House settlement implementation and may need to update or create new structures in existing financial systems to accurately capture these costs. Not only must coaches and student‑athletes stay informed, but ABO staff must also ensure policies, procedures, and internal controls are functioning appropriately to keep pace. This article highlights key areas auditors should consider as they work to support the ABO in a rapidly evolving collegiate athletics environment.

Background

The College Sports Commission (CSC) is the entity created by the “Power” conferences (Atlantic Coast Conference (ACC), Big Ten, Big XII, and Southeastern Conference (SEC)) to oversee the implementation of the House settlement, including mandating the use of two new systems:

- NIL Go is the online platform used by student-athletes to report new third-party NIL deals over $600, with reporting expected within 5 days of each executed deal.

- College Athlete Payment System (CAPS) is for entering revenue-sharing payments made against the annual cap ($20.5 million in FY25-26).

Financial Management

The first area of biggest impact is on the financial stability of athletics’ operations. Key risks to keep in mind regarding financial implications include:

- Financial instability leads to the elimination or reduction of key services, personnel, and non-revenue generating sports.

- Inability to sustain maintenance or facility improvements, debt service, or salaries.

- Use of restricted or unallowable sources of funds to cover revenue-sharing expenses.

- Failure to adapt and innovate financial modeling needs to consider both cost reduction and revenue maximization.

- Increased travel and booking costs due to conference realignments.

- Misalignment with institution leadership regarding how revenue share payments will be allocated among sports.

- Overcommitment of funds through coaching decisions, contractual guarantees, offered Alston settlement benefits, incremental scholarships, or contingent payments included in agreements.

- Financial statement misstatement due to improper allocation or reporting of revenue‑sharing funds.

- Future litigation in the NIL and revenue-sharing space could lead to unexpected financial losses.

- Inaccurate tracking, which results in financial penalties for exceeding the revenue-sharing cap or incremental scholarship cap.

- Long-term financial risks related to private equity investment.

Contract Management

Another area to consider involves contract management. Organizations use contracts to obtain different services or products at all levels of athletics. Additionally, contracts are now being used more frequently to guarantee payments to student-athletes, adding a new risk area. ABOs should consult with university counsel to create standard agreement templates to reduce contract risks. In some areas, ABOs may work in collaboration with Athletics Compliance to institute new procedures to mitigate these risks. Some specific risks related to contract management with student-athletes include:

- Student-athletes and coaches create informal NIL agreements and do not properly document them in an approved contract format.

- Staffing shortages delay contract processing, approval and or payment, particularly during new enrollment and transfer portal periods.

- Student-athletes fail to report NIL deals with third parties via the NIL Go Clearinghouse (for fair market value and valid business purpose review).

- There is no centralized process to ensure revenue-sharing contracts are appropriately tracked and reported to the ABO for financial processing.

- Standardized revenue sharing agreements are unenforceable or fail to address early departures, ineligibility, buy-outs, or other unique terms.

- Contract language that creates risks for international student-athletes receiving payments, based on their visa type.

- Institutional contracts combine NIL and revenue share distributions, creating tracking complexity (only allowable if NIL payment is from the institution not a third party; any guaranteed institutional NIL included in these contracts must also count towards the revenue-sharing cap).

- Contracts overstate or over-promise funds or commitments to student-athletes that must be paid out regardless of situation (e.g., student-athlete leaving early with large upfront payments already occurring).

- Inadequate third party contracts for services or software to issue or track payments to student-athletes.

- Managing potential conflict with pre-existing institutional partnerships and exclusivity clauses.

- Contracted payment dates to student-athletes that do not consider internal or third-party lead-time needed to establish payment processing (e.g., can you pay the student-athlete on day one of enrollment? This is especially important with portal management).

- Exposure of sensitive student-athlete data (i.e., banking information, contract terms, etc.).

- Over reliance or misunderstanding related to third-party tools and reporting (e.g., are roles and responsibilities clearly defined between parties, are data inputs and outputs well understood, and is there monitoring in place to identify issues?).

- Future compliance issues with Title IX based on revenue-sharing allocations.

ABO Potential Procedures

With so many new and expanded risks, the ABO should consider implementing the following additional controls and procedures:

Roles and Responsibilities

- Identify the finance and budget lead.

- Identify revenue share and NIL point personnel.

- Establish approval authority for revenue contracts (Athletic Director involvement, coach authority, etc.).

- Verify separation of duties for revenue sharing and NIL (i.e., contract creation, contract approval, disbursement, and reconciliation).

- Create new processes to initiate and record revenue-sharing agreements by contracted dates.

- Ensure that new processes incorporate all types of revenue-sharing benefits (e.g., is your institution providing additional benefits such as Alston requirements?).

- Ensure access to private data (i.e., contract amounts and bank routing information) is limited to applicable employees, and there are privacy safeguards within the software, excel spreadsheets, google docs, etc.

Reconciling and Monitoring

- Verify gross conference distributions against revenue sharing payments.

- Ensure agreement between the CAPS system to actual disbursements to contracted amounts ,and document known differences or offsets, in preparation for year-end CSC reporting of revenue-sharing payments.

- Reconcile revenue share payments in total to per-sport allocations.

- Identify communication channels to ensure ongoing collaboration and monitoring (likely by Compliance) to ensure payments are made only to eligible student-athletes included on rosters.

- Monitor cap balances regularly to ensure alignment with institutional allocations.

- Consider timely communication with stakeholders, and when approaching key thresholds (e.g., 75% of allowable distributions made).

- Potentially build multi-year forecasts and implications to the budget.

- Confirm payment distribution method (i.e., direct deposit, monthly, quarterly, tax withholdings, etc.).

- Verify NIL opportunities exceeding $600 are disclosed, tracked separately from revenue sharing, and are reported through NIL Go.

Training and Communication

- Train ABO staff and other applicable staff members involved in the NIL and revenue-sharing transactions on NCAA and CSC regulations, as well as applicable institution policies regarding contract management, revenue handling, and disbursement procedures.

- Train ABO staff and other applicable staff members on the new software that will be used in the NIL and revenue-share process, including privacy (HIPAA/FERPA) and security awareness.

- Verify staff knowledge aligns with the new tasks, such as financial forecasting and planning.

- Ensure staff capacities are not being exceeded, leading to gaps in other business office processes.

- Meet with coaches/administrative staff to ensure all are aligned on the procedures and update them regularly regarding current cap balances and applicable finance situations.

- Review institutional travel policies and ensure institutional compliance can be maintained with the increase in travel costs due to conference realignments.

- Document and communicate revenue-sharing allocation methodology to ensure applicable ABO staff members and others (i.e., coaches, ABO, Compliance, institutional leadership, etc.) are aligned and tracked toward agreed amounts.

Internal Audit’s Role

So, you are probably asking yourself, “How can Internal Audit help?” or “I am not an expert on the new requirements, what can I do?” Athletics, despite operating in a very public and rapidly changing environment, can benefit from Internal Audit in a similar way as any other campus unit. For example, Internal Audit can:

- Evaluate the governance framework in place related to revenue-sharing allocations and strategies.

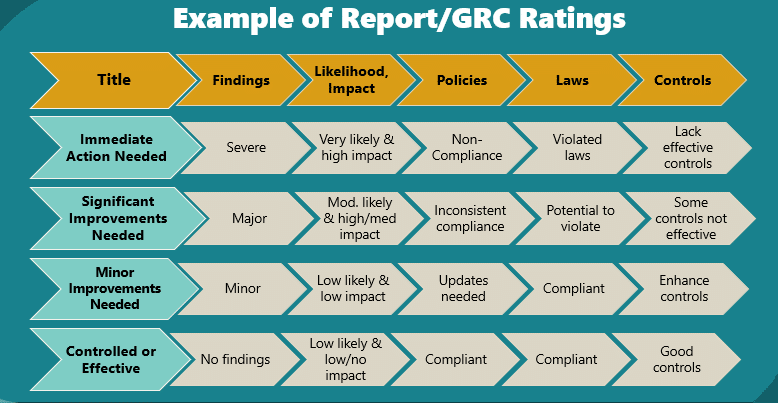

- Help evaluate risks and offer an independent and objective assessment of the controls in place to mitigate these risks.

- Review reconciliation processes for student-athlete payments and assess segregation of duties within revenue‑processing workflows.

- Evaluate communication and training related to NCAA bylaw and CSC rules requirements for NIL licensing and revenue-sharing.

- Conduct advisory engagements on new or evolving processes.

- Ensure process changes still align with institution policy.

While this is just sample of considerations for the ABO, oversight by other offices is also important (i.e., Athletic Compliance, Office of the General Counsel, Tax Office, etc.) Feel free to share this article with your contacts in the ABO. Even sharing best practices and relevant articles with your ABO can provide value. It is more important than ever that the ABO knows where every dollar is going, why it is going there, and whether it aligns with applicable policies and procedures. As Athletics continues to evolve rapidly, auditors play a critical role in ensuring transparency, strong internal controls, and responsible stewardship of university resources.