Methodology Madness: New Standards Guidance for Formalizing Audit Processes

By Kara Hefner

It has been one year since the implementation of the Institute of Internal Auditors’ (IIA) new Global Internal Audit Standards (Standards). Everyone can agree the Standards have become more prescriptive, with more “musts” and “shoulds” than in prior guidance. Another term has come to the forefront: the word “methodology” is found 109 times throughout the 120-page document. There are 13 standards that require documented methodologies, and 17 more that recommend either implementing methodologies or having documented methodologies to provide evidence of conformance.

Gone are the days of simply relying on professional judgment, winging it, and relying on passing the smell test. This article outlines the required and recommended methodologies to aid in consistently application of audit processes.

What are Methodologies?

The term “methodologies” is defined in the Standards’ glossary as “policies, processes, and procedures established by the chief audit executive to guide the internal audit function and enhance its effectiveness.”

As described in Standard 9.3 on Methodology, the chief audit executive must establish methodologies to guide the internal audit function in a systematic and disciplined manner to implement the internal audit strategy, develop the internal audit plan, and conform with the Standards. These methodologies must be evaluated and updated as necessary to improve the internal audit function and respond to significant changes that affect the function. Internal auditors should be trained in the methodologies to ensure consistency within the department.

Documented methodologies are often found in the department’s formal procedure manual, audit charter, and board charter. Some methodologies can be built into workpaper templates, and ratings methodologies are sometimes included for transparency in the final audit reports. It is important that all auditors are familiar with the department’s methodologies, and that reviewers ensure methodologies are consistently applied.

Required Methodologies

Excluding the Methodology standard 9.3 discussed above, the following 12 standards require methodologies to be in place:

| Standard | Methodology Requirement (abbreviated) |

| 2.2 Safeguarding Objectivity | The chief audit executive must establish methodologies to address impairments to objectivity. Internal auditors must discuss impairments and take appropriate actions according to relevant methodologies. |

| 4.1 Conformance with the Global Internal Audit Standards | The internal audit function’s methodologies must be established, documented, and maintained in alignment with the Standards. |

| 11.2 Effective Communication | The chief audit executive must establish and implement methodologies to promote accurate, objective, clear, concise, constructive, complete, and timely internal audit communications. |

| 12.1 Internal Quality Assessment | The chief audit executive must establish a methodology for internal assessments, as described in Standard 8.3 Quality, that includes ongoing monitoring, periodic self-assessments, and communication with the board and senior management about the results of internal assessments. |

| 12.2 Performance Measurement | The chief audit executive must develop a performance measurement methodology to assess progress toward achieving the function’s objectives and to promote the continuous improvement of the internal audit function. |

| 12.3 Oversee and Improve Engagement Performance | The chief audit executive must establish and implement methodologies for engagement supervision, quality assurance, and the development of competencies. To assure quality, the chief audit executive must verify whether engagements are performed in conformance with the Standards and the internal audit function’s methodologies. The chief audit executive must ensure that evidence of supervision is documented and retained, according to the internal audit function’s established methodologies. |

| 13.1 Engagement Communication | At the end of an engagement, if internal auditors and management do not agree on the engagement results, internal auditors must follow an established methodology to allow both parties to express their positions regarding the content of the final engagement communication and the reasons for any differences of opinion regarding the engagement results. |

| 13.3 Engagement Objectives and Scope | If a resolution on scope limitations cannot be achieved with management, the chief audit executive must elevate the scope limitation issue to the board according to an established methodology. |

| 13.6 Work Program | The engagement work program must identify methodologies, including the analytical procedures to be used, and tools to perform the tasks. |

| 14.3 Evaluation of Findings | Internal auditors must determine whether to report identified risks as findings, based on the circumstances and established methodologies. Internal auditors must prioritize each engagement finding based on its significance, using methodologies established by the chief audit executive. |

| 14.4 Recommendations and Action Plans | If internal auditors and management disagree about the engagement recommendations and/ or action plans, internal auditors must follow an established methodology to allow both parties to express their positions and rationale and to determine a resolution. |

| 15.2 Confirming the Implementation of Recommendations or Action Plans | Internal auditors must confirm that management has implemented their action plans following an established methodology, which includes inquiring about progress, performing follow-up assessments, and updating tracking systems. |

Recommended Methodologies

The Standards also recommend implementing methodologies for other topics under their Considerations for Implementation and Evidence of Conformance categories. These recommendations are summarized below by domain:

- Domain II: Ethics & Professionalism – Methodologies may be created for addressing ethical issues, disclosing objectivity impairments, and handling illegal or discreditable behavior by internal auditors. Methodologies can specify actions internal auditors are expected to take in response to legal or regulatory violations of which they become aware. Memorialize the manner in which internal audit staff are properly supervised and the permissible ways auditors may access information. (Standards 1.2, 1.3, 2.3, and 5.2)

- Domain III: Governance – Consider documenting methodologies to be followed when an organizational impairment is suspected or identified. Formally document the board’s expectations. The external quality assessment should include a comprehensive review of methodologies and their adequacy. (Standards 7.1, 8.1, and 8.4)

- Domain IV – Managing – Methodologies are recommended for creating and reviewing the internal audit strategy, creation of the annual audit plan, communicating with the board and senior management, handling of errors and omissions, and evaluating external providers of assurance and advisory services. To develop and retain internal auditors, have a methodology for staff training, project supervision, evaluating performance, improving competencies, and promoting professional development. Develop methodologies for communicating the acceptance of risks with collaboration from the board. (Standards 9.2, 9.4, 9.5, 10.2, 11.1, 11.4, and 11.5)

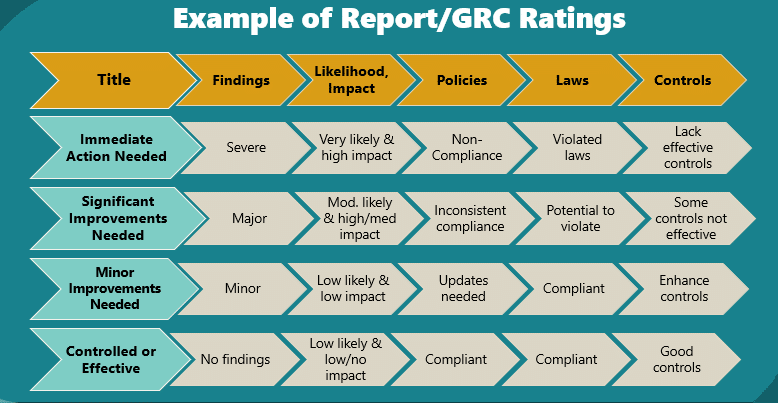

- Domain V: Performing – Adopt methodologies for when to perform additional analysis, considering the adequacy of controls, significance, and cost benefit analysis. Implement a rating scale for determining the effectiveness of controls for the final report. For example, develop a scale to identify satisfactory, partially satisfactory, needs improvement, or unsatisfactory. (Standards14.2, 14.5, and 14.6)

Establishing and Improving Methodologies

Now that most internal audit shops have adopted the new Standards, this is a good time to check up on the required and recommended methodologies. Review the Standards against the procedure manual, charters, and workpaper templates and identify any methodologies that should be created or enhanced. Consider formalizing rating scales to aid in ranking findings and conclusions for final reports. Discuss methodology enhancements with your board to ensure alignment.

Once established, perform ongoing monitoring to ensure methodologies are in place and used consistently. Reviewers should verify workpapers follow the established methodology and help coach their team on process deviations. Periodic self-assessments and external assessments can also aid in providing feedback on the effectiveness of your methodologies.